Need Help Funding Your Equipment?

Leasing Your Equipment

From £1000 upwards, we have solutions that suit your cash flow and budget.

Ascot Wholesale Limited have partnered up with Kennet Equipment Leasing Limited to offer you a wide range of finance options, from lease to HP.

What is Finance Lease?

Finance Lease is a credit agreement most usually chosen by business customers including limited companies, partnerships, and sole traders. Essentially, Finance leasing enables the business to acquire the assets needed to maintain a business, without needing to buy the asset outright.

Benefits of Leasing:

1. Finance Leases offer flexibility in terms of length of agreement, rental repayment profile and end of lease options.

2. Unlike making an outright purchase, you will retain cash within your business.

3. Effective financial planning. The lease repayment profile gives you confidence in being able to budget for the lifetime of the asset.

4. Tax advantages

5. Using the latest assets will ensure you remain competitive by keeping your costs low.

6. Fast turnaround times

7. Potential to carry on using the asset at the end of the lease period for a nominal payment, or you can look to upgrade the equipment with another lease.

Things to be mindful of:

1. The agreement is secured against the asset.

2. Non-payment could negatively affect the credit rating of the business and the guarantor.

Benefits of Hire Purchase:

1. Rather than one large sum, you can spread the cost over a 3 to 5 year period.

2. Makes larger more expensive assets more affordable to the business.

3. Flexibility, you can choose a fixed term and deposit that suits you.

4. As the hire purchaser, you’ll own the asset after paying the last instalment.

5. There are usually no taxes charges on Hire Purchase agreements.

6. Hire Purchase can be paid off early, depending on the customer.

What is a Hire Purchase?

Hire purchase is a form of finance that can be used to buy new or used equipment. You essentially hire the asset over the contract period and once the facility has been paid off, you are the legal owner of the asset. Payments and interest rates are generally both fixed, although prior arrangements can be made to add flexibility to repayments depending on your financial situation.

Things to be mindful of:

1. Asset Depreciation.

2. Non-payment could negatively affect the credit rating of the business and the guarantor and could result in the asset being re-possessed.

Ascot Wholesale Limited are an Introducer Appointed Representative of Kennet Equipment Leasing Limited. Kennet Equipment Leasing Limited are authorised and regulated by the Financial Conduct Authority, FRN:676024. Kennet Equipment Leasing Limited is an authorised Credit Broker and Lender.

How To Go Ahead

Once you have found the perfect item and you wish to go ahead and purchase it from Ascot Wholesale via the leasing options below:

Make a note of the equipment name and price and call our sales office on 01256 769990 to request a proposal form.

OR

Complete our simple Leasing Form below to get the process started.

One of our leasing companies will contact you as soon as possible to discuss your requirements.

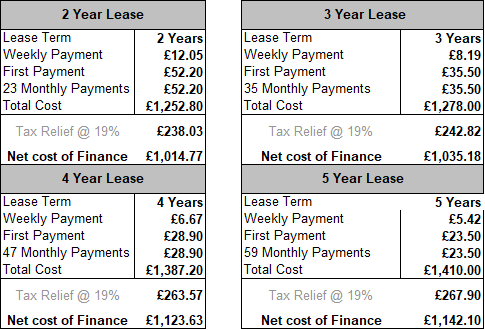

Leasing Finance Examples

Example figures for Equipment worth £1,000 (ex VAT):

Subject to status and credit checks.

Do You Have Any Queries?

If you have any queries, please don't hesitate to contact our Sales Department to discuss your requirements.

Call us on 01256 769990

Email us at sales@ascotwholesale.co.uk

By completing your data within these fields you are consenting to Ascot Wholesale contacting you directly.

Validate your login

Login

Create New Account